Program

COVID-19 Federal Assistance e311Topics

Fund Planning & AllocationFunding Source

American Rescue Plan ActCan funds for an entitlement city, not resulting from revenue loss, and not in a Qualified Census Tract be used for: 1) improvements to public safety facilities; 2) HVAC replacements in city facilities; 3) renewable energy improvements to city facilities?

The ARP does allow for structural renovations so long as these improvements mitigate and prevent the spread of COVID-19.[1] However, guidance issued by the U.S. Department of the Treasury (“Treasury”) does not specifically address the use of funds from the American Rescue Plan Act of 2021 (“ARP”) for the purchase of renewable energy improvements to city facilities.

Section 603(c)(1)(A) of the ARP authorizes municipalities to use Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”) to meet public health and economic needs resulting from the COVID-19 public health emergency.[2] The list of eligible uses in the public health section outlined in Treasury’s Final Rule authorizes the use of funds to mitigate and prevent the spread of COVID-19.[3] The non-exclusive list of allowable uses includes “support for prevention, mitigation, or other services in congregate living facilities … ventilation improvements in congregate settings, health care settings, or other key locations … [and] capital investments in public facilities to meet pandemic operational needs.”[4] Inasmuch as public safety facilities may be congregate living facilities or open to the public, certain renovations to implement COVID-19 mitigation tactics in these buildings are likely eligible for CSLFRF funding.[5]

Renovations that improve social distancing, allow better sanitation, and otherwise mitigate and prevent the spread of COVID-19 will also likely be considered authorized uses of CSLFRF. For updates to HVAC systems and other projects not specifically mentioned in the Final Rule, municipalities must identify and document proper justification for the use of CSLFRF on these projects. As stated in the Final Rule, municipalities must “identify an effect of COVID-19 on public health, including either or both of immediate effects or effects that may manifest over months or years, and assess how the use would respond to or address the identified need.”[6]

Moreover, Treasury allows CSLFRF for “[c]osts to improve the design and execution of programs responding to the COVID-19 pandemic and to administer or improve the efficacy of programs addressing the public health emergency or its negative economic impacts.”[7] But Treasury explains in the Final Rule that capital expenditures “must be reasonably designed to benefit the individual or class that experienced the impact or harm and must be related and reasonably proportional to the extent and type of impact or harm.”[8]

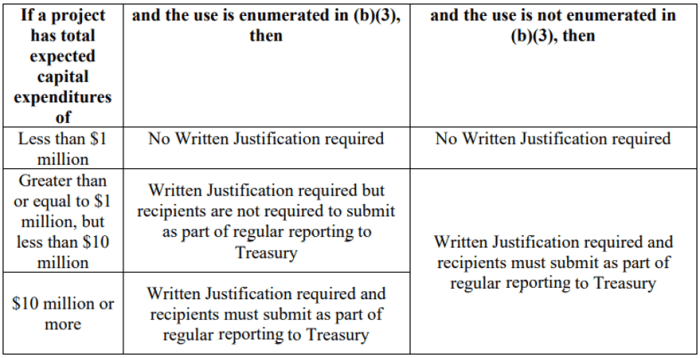

Treasury further requires CSLFRF recipients to provide a written justification for specific capital expenses:

A recipient, other than a Tribal government, must prepare a written justification for certain capital expenditures according to Table [currently displayed but undesignated in Treasury Guidance]. Such written justification must include the following elements:

- Describe the harm or need to be addressed;

- Explain why a capital expenditure is appropriate; and

- Compare the proposed capital expenditure to at least two alternative capital expenditures and demonstrate why the proposed capital expenditure is superior.

In addition, municipalities are permitted to use CSLFRF to support improvements to city facilities under the physical health and economic impacts section of ARP.[10] Municipalities should prioritize identifying the contributing factors to the spread of COVID-19 among such facilities in determining how to best reduce or eliminate these factors to best adhere to the guidelines established by Treasury in the Final Rule.[11]

Last Revised: February 2, 2022

[1] Treas. Reg. 31 CFR 35 at 56, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] Id., at 53 and 79.

[3] Id., at 55.

[4] Coronavirus State and Local Fiscal Recovery Funds, Frequently Asked Questions #2.1 (as of July 19, 2021), available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[5] Id.

[6] Treas. Reg. 31 CFR 35 at 15, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[7] Id., at 422.

[8] Id., at 194.

[9] Id., at 422.

[10] Id., at 18.

[11] Id., at 10.