COVID-19 Federal Assistance e311

Program

COVID-19 Federal Assistance e311Topics

Lost Revenue & Revenue ReplacementFunding Source

American Rescue Plan ActCan a municipality include an increase in the property tax rate when calculating the average revenue for the past three years?

The U.S. Department of the Treasury (“Treasury”) issued the Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”) Final Rule as part of the American Rescue Plan Act of 2021 (“ARP”). The Final Rule provides state and local governments with increased flexibility to pursue a wider range of uses, as well as greater simplicity so governments can focus on responding to the crisis in their communities and maximizing the impacts of their funds.

To show the overall effect of the pandemic on a recipient’s fiscal health, revenue loss must be calculated on an aggregate basis.[1] Treasury recognizes that recipients may have a reduction in revenue that is, over time, offset by other revenue such as tax increases. Therefore, the Final Rule “requires recipients that increased taxes to deduct the amount of increases to revenue attributable to such tax increase.”[2] In evaluating whether a tax change had the effect of increasing tax revenue, the Final Rule allows recipients to either calculate the actual effect on revenue or use estimates prepared at the time the tax change was adopted.[3] This approach allows recipients to more accurately capture revenue loss caused by the public health emergency. Because property tax revenue loss is an approved use of SLFRF, municipalities should follow the calculation process described in the Final Rule to determine the amount of loss and refer to the allowable calculation dates for accounting purposes.[4],[5]

In response to public comment, the Final Rule adds an option for recipients to use a standard allowance for revenue loss. This fixed loss amount is set at $10 million total for the entire period of performance, and recipients may use the standard allowance as an alternative to calculating revenue loss. The Final Rule states that “Treasury intends to amend its reporting forms to provide a mechanism for recipients to make a one-time, irrevocable election to utilize either the revenue loss formula or the standard allowance.”[6]

Additional information may be provided when Treasury issues new Frequently Asked Questions (“FAQs”) specific to the Final Rule.[7] In addition, Treasury encourages municipalities to consider the guidance issued in the Statement Regarding Compliance with the Coronavirus State and Local Fiscal Recovery Funds Interim Final Rule and Final Rule.[8]

Last Revised: February 1, 2022

[1] Treas. Reg. 31 CFR 35 at 247-248, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] Id., at 255.

[3] Id., at 255-256.

[4] Id., at 236-238.

[5] Id., at 248-249.

[6] Id., at 240.

[7] Coronavirus State and Local Fiscal Recovery Funds, Frequently Asked Questions (as of January 2022), at 1 available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[8] U.S. Department of the Treasury, Statement Regarding Compliance with the Coronavirus State and Local Fiscal Recovery Funds Interim Final Rule and Final Rule, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-Statement.pdf.

Program

COVID-19 Federal Assistance e311Topics

Lost Revenue & Revenue ReplacementFunding Source

American Rescue Plan ActHow should a city calculate its revenue if its fiscal calendar changed in 2020?

The American Rescue Plan Act of 2021 (“ARP”) Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”) provide fiscal relief for recipients that have experienced revenue loss due to the onset of the COVID-19 public health emergency.[1]

Under the CSLFRF Final Rule,[2] the U.S. Department of the Treasury (“Treasury”) outlines two distinct options for recipients to determine their amount of revenue loss. Recipients must choose one of these options and cannot switch between these approaches after making an election:

- recipients may elect a “standard allowance” of $10 million to spend on the provision of government services through the period of performance; or

- recipients may calculate their actual revenue loss (using actual revenues and not projections) according to the formula articulated in the Final Rule.[3]

If recipients choose the first option, Treasury will presume that up to $10 million in revenue has been lost due to the public health emergency, and recipients will be permitted to use that amount (not to exceed the award amount) to fund the provision of eligible government services. All recipients may elect to use this standard allowance instead of calculating lost revenue using the formula below, including those with total allocations of $10 million or less. Electing the standard allowance does not increase or decrease a recipient’s total allocation.[4]

Recipients choosing the second option may calculate revenue loss at four distinct points in time, either at the end of each calendar year (e.g., December 31 for years 2020, 2021, 2022, and 2023) or the end of the recipient’s fiscal year. Under the flexibility provided in the Final Rule, recipients can choose whether to use calendar or fiscal year dates but must be consistent throughout the period of performance.[5] As the Final Rule does not explicitly address accounting for the impact of changes to fiscal years, it may be advisable to use consistent full years with identical start and end dates.

To calculate revenue loss at each of these dates, recipients must follow a four-step process:

- Calculate revenues collected in the most recent full fiscal year prior to the public health emergency (i.e., last full fiscal year before January 27, 2020), called the base year revenue.

- Estimate counterfactual revenue, which is equal to the following formula, where n is the number of months elapsed since the end of the base year to the calculation date:

[???? ???? ??????? × (1 + ?????ℎ ??????????)] ^ (?/12)

The growth adjustment is the greater of either a standard growth rate—5.2 percent—or the recipient’s average annual revenue growth in the last full three fiscal years prior to the COVID-19 public health emergency.

- Identify actual revenue, which equals revenues collected over the twelve months immediately preceding the calculation date.

- Under the Final Rule, recipients must adjust actual revenue totals for the effect of tax cuts and tax increases that are adopted after the date of adoption of the Final Rule (January 6, 2022). Specifically, the estimated fiscal impact of tax cuts and tax increases adopted after January 6, 2022, must be added or subtracted to the calculation of actual revenue for purposes of calculation dates that occur on or after April 1, 2022.

- Recipients may subtract from their calculation of actual revenue the effect of tax increases enacted prior to the adoption of the Final Rule. Note that recipients that elect to remove the effect of tax increases enacted before the adoption of the Final Rule must also remove the effect of tax decreases enacted before the adoption of the Final Rule, such that they are accurately removing the effect of tax policy changes on revenue.

- Revenue loss for the calculation date is equal to counterfactual revenue minus actual revenue (adjusted for tax changes) for the twelve-month period. If actual revenue exceeds counterfactual revenue, the loss is set to zero for that twelve-month period. Revenue loss for the period of performance is the sum of the revenue loss on for each calculation date.[6]

The supplementary information in the Final Rule provides an example of a full revenue loss calculation.[7]

Last Revised: February 16, 2022

[1] Coronavirus State & Local Fiscal Recovery Funds: Overview of the Final Rule, at 9, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule-Overview.pdf.

[2] Treas. Reg. 31 CFR 35, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[3] Coronavirus State & Local Fiscal Recovery Funds: Overview of the Final Rule, at 9, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule-Overview.pdf.

[4] Id.

[5] Coronavirus State & Local Fiscal Recovery Funds: Overview of the Final Rule, at 9, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule-Overview.pdf.

[6] Id., at 10.

[7] Id., at 233-239.

Program

COVID-19 Federal Assistance e311Topics

Housing & Rental AssistanceFunding Source

American Rescue Plan Act, CARES Act, FEMA, HUDHow can a city use federal funds to help residents with overdue utility payments?

Generally, municipalities may access several different programs established or expanded by the American Rescue Plan Act of 2021 (“ARP”) to help residents with overdue utility bills during the period of the COVID-19 public health emergency.

The U.S. Department of the Treasury’s (“Treasury”) Final Rule on the Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”) lists overdue utility bills during the COVID-19 pandemic as a form of household assistance.[1] Additionally, these utility bills may predate March 3, 2021 as long as the economic impact of the COVID-19 pandemic caused the overdue bills and the cost of providing assistance to the household was not incurred by the municipality prior to March 3, 2021.[2] Treasury guidance does not indicate whether these payments for utility bills may be made directly to the service provider or if they must be paid to the resident. Rather, the Final Rule states that in considering whether a potential use is eligible under this category, a recipient (i.e., the municipality) must consider whether, and the extent to which, the household has experienced a negative economic impact from the pandemic.[3]

The Final Rule clarified the definition of households and communities that are impacted under CSLFRF:

- Low- or-moderate income households or communities;

- Households that experienced unemployment;

- Households that experienced increased food or housing insecurity;

- Households that qualify for the Children’s Health Insurance Program, Childcare Subsidies through the Child Care Development Fund (CCDF) Program, or Medicaid;

- When providing affordable housing programs: households that qualify for the National Housing Trust Fund and Home Investment Partnerships Program;

- When providing services to address lost instructional time in K-12 schools: any student that lost access to in-person instruction for a significant period of time.[4]

The Emergency Rental Assistance Program (“ERAP”), expanded through the ARP, also includes utility assistance for households that pay rent (but not for homeowners) and meet other income and financial hardship criteria[5] as an eligible use.[6] Both ERAP1 and ERAP2 funds can be used for this purpose if conditions are met. ERAP encourages (and in the case of ERAP1 funds, requires) recipients to work directly with utility providers to pay for utility bills for renters who have overdue utility bills.[7] All payments through this program must be associated with an invoice, bill, or evidence of payment for overdue payments, as well as documentation of the eligibility of the recipient.[8] Treasury has not published further guidance for municipalities that control utilities, but as noted above, does encourage direct payment to utility providers.

The Homeowner Assistance Fund (“HAF”), likewise established by the ARP, also includes utilities as an eligible use, but encourages municipalities “to consider program designs that leverage utility assistance from other federal programs that have been created expressly for that purpose before using HAF funds for utility assistance.”[9] Additionally, any household that receives funding from this program must submit attestations and documentation of their financial hardship and other eligibility requirements.[10]

The ARP also provided supplemental funding to the Low Income Home Energy Assistance Program (“LIHEAP”). Utility bills are also an eligible use of LIHEAP funds.[11] This program is administered through states, tribes, and territories.[12]

For example, if determined a necessary expenditure, a government may be able to provide grants to individuals facing economic hardship to allow them to pay their utility fees and thereby continue to receive essential services.

In conclusion, there are several avenues a municipality may wish to take to provide utility assistance to residents with overdue utility payments. In general, assistance is limited to residents facing economic hardships, though each program has its additional eligibility and program requirements. Municipalities should first complete a needs assessment to tailor the use of federal funds and maximize relief for its residents’ hardships.

Treasury may provide additional information when it issues new Frequently Asked Questions (“FAQs”) associated with the Final Rule.

Last Updated: March 31, 2022

[1] Treas. Reg. 31 CFR 35 at 80, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] Coronavirus State and Local Fiscal Recovery Funds, Frequently Asked Questions (as of January 2022), at FAQ #4.7, at 21, available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[3] Treas. Reg. 31 CFR 35 at 22, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[4] Department of Treasury, Coronavirus State & Local Fiscal Recovery Funds: Overview of the Final Rule, (as of January 2022), at 17, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule-Overview.pdf.

[5] These criteria vary slightly between ERAP1 and ERAP2. See Department of Treasury, Emergency Rental Assistance Frequently Asked Questions (as of June 24, 2021), at FAQ #1, at 1, available at: https://home.treasury.gov/system/files/136/ERA_FAQs_6-24-21.pdf.

[6] Id., at FAQ #6, at 6.

[7] Id., at FAQ #12, at 7-8.

[8] Id., at FAQ # 6, at 6.

[9] Department of the Treasury, Homeowner Assistance Fund Guidance (as of February 24, 2022), at 8, available at: https://home.treasury.gov/system/files/136/HAF-Guidance.pdf.

[10] Id., at 6.

[11] U.S. Department of Health and Human Services, LIHEAP FAQs for Consumers, at FAQ #2, available at https://www.acf.hhs.gov/ocs/faq/liheap-faqs-consumers#Q2.

[12] U.S. Department of Health and Human Services, Low Income Home Energy Assistance Program (LIHEAP) Home Page, available at: https://www.acf.hhs.gov/ocs/low-income-home-energy-assistance-program-liheap.

Program

COVID-19 Federal Assistance e311Topics

Housing & Rental AssistanceFunding Source

American Rescue Plan ActAre the costs of a universal basic income program an eligible use of ARP funding?

Assuming that “universal basic income” (“UBI”) is defined as a government program in which every adult citizen receives a set amount of money from the government without a means test on a regular basis, a municipality’s implementation of such a program will most likely not be considered an eligible use of funds obtained from the American Rescue Plan Act of 2021 (“ARP”). Neither the statute nor the U.S. Department of the Treasury’s (“Treasury”) Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”) Final Rule includes UBI as an eligible use.

There are four eligible use categories of CSLFRF funds:

- Responding to the public health and negative economic impacts of the pandemic

- Providing premium pay to essential workers

- Providing government services to the extent of revenue loss due to the pandemic, and

- Making necessary investments in water, sewer, or broadband infrastructure.[1]

UBI payments to all citizens would not be eligible as a public health response to the pandemic. Nor would UBI payments be authorized as a form of premium pay to essential workers or as an investment in water, sewer, or broadband infrastructure. In addition, there is no indication in the ARP or the Final Rule that Treasury would consider UBI payments to be eligible as a government service. Therefore, depending on one’s definition of UBI, it is not clear whether Treasury would consider a recipient’s implementation of such a program to be an eligible use of CSLFRF funds.

The Final Rule describes eligible uses of CSLFRF assistance without addressing the concept of UBI.[2] The Final Rule notes:

A program, service, or capital expenditure responds to a harm or impact experienced by an identified beneficiary or class of beneficiaries if it is reasonably designed to benefit the beneficiary or class of beneficiaries that experienced the harm or impact and is related and reasonably proportional to the extent and type of harm or impact experienced.[3]

It is not clear from Treasury’s guidance whether the agency would consider UBI payments to all citizens to be “reasonably proportional” to the harm or impact caused by the pandemic.

It is noteworthy that the Final Rule authorizes the payment of “cash assistance” to households that have been impacted by the pandemic. The Final Rule states that eligible CSLFRF assistance includes:

Assistance to households and individuals, including: (1) Assistance for food; emergency housing needs; burials, home repairs, or weatherization; internet access or digital literacy; cash assistance; and assistance accessing public benefits.[4]

The Supplementary Information discussion which accompanies the Final Rule discusses the provision of cash assistance and states in pertinent part:

The interim final rule included as an enumerated eligible use cash assistance and provided that cash transfers must be “reasonably proportional” to the negative economic impact they address and may not be “grossly in excess of the amount needed to address” the impact. In assessing whether a transfer is reasonably proportional, recipients may “consider and take guidance from the per person amounts previously provided by the Federal Government in response to the COVID-19 crisis,” and transfers “grossly in excess of such amounts” are not eligible…. Cash transfers, like all eligible uses in this category, must respond to the negative economic impacts of the pandemic on a household or class of households….recipients may presume that low- and moderate-income households…as well as households that experienced unemployment, food insecurity, or housing insecurity, experienced a negative economic impact due to the pandemic. Recipients may also identify other households or classes of households that experienced a negative economic impact of the pandemic and provide cash assistance that is reasonably proportional to, and not grossly in excess of, the amount needed to address the negative economic impact…. Treasury has reiterated in the final rule that responses to negative economic impacts should be reasonably proportional to the impact that they are intended to address. Uses that bear no relation or are grossly disproportionate to the type or extent of harm experienced would not be eligible uses.[5]

In addition to these provisions in the Final Rule and the Supplementary Information discussion, Treasury has published Frequently Asked Questions (“FAQs”) on CSLFRF assistance. FAQ #2.5, pertaining to the types of services eligible as responses to the negative economic impacts of the pandemic, states:

Eligible uses in this category include assistance to households…. Assistance to households includes, but is not limited to: food assistance; rent, mortgage, or utility assistance; counseling and legal aid to prevent eviction or homelessness; cash assistance; emergency assistance for burials, home repairs, weatherization, or other needs.[6]

While this answer to FAQ #2.5 explicitly refers to the use of CSLFRF assistance to provide cash assistance to households, in the context of the other listed types of assistance to households, it appears that Treasury considers the reference to cash assistance to mean short-term assistance, rather than longer-term UBI funding that might be provided irrespective of the pandemic’s impact on the beneficiaries of such assistance and irrespective of any means testing.

Notably, the Final Rule highlights specific eligible services to support low-income areas that have been unduly impacted by the pandemic by:

- Establishing definitions of essential workers eligible for premium pay;[7]

- Encouraging Fiscal Recovery Funds recipients to serve workers based on financial need;[8]

- Providing that recipients may use Fiscal Recovery Funds to restore (to pre-pandemic levels) state and local workforces where women and people of color are disproportionately represented; and[9]

- Targeting investments in broadband infrastructure to unserved and underserved areas.[10]

Treasury has also provided a succinct overview of the Final Rule, which outlines additional enumerated eligible uses regarding assisting impacted households. This can be found on page 18 of the Final Rule Overview document.[11] Furthermore, Treasury has outlined other enumerated eligible uses for disproportionately impacted households on page 20 of the Final Rule Overview document.[12]

For quick reference in determining low and moderate-income ("LMI") households regarding the differentiation of impacted and disproportionately impacted households to determine eligible uses of funds under the Final Rule, reference Treasury's provided Tool for Determining LMI Households.[13]

However, neither the statute nor any other Treasury guidance explicitly discusses the concept of using CSLFRF assistance to fund UBI programs. Therefore, the answer to this question depends on the specific criteria that a recipient might use to structure a possible UBI program which is reasonably proportional to the impact of the pandemic on UBI beneficiaries.

It should be noted that additional information may be provided when Treasury issues new FAQs specific to the Final Rule, as indicated in the interim Final Rule FAQ.[14] In addition, Treasury encourages municipalities to consider the guidance issued in the Statement Regarding Compliance with the Coronavirus State and Local Fiscal Recovery Funds Interim Final Rule and Final Rule.[15]

Last updated: March 7, 2022

[1] Treas. Reg. 31 CFR 35 at 8, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] Id., at 414-431.

[3] Id., at 415 (emphasis added).

[4] Id., at 418 (emphasis added).

[5] Id., at 90-91 (emphasis added).

[6] Coronavirus State and Local Fiscal Recovery Funds, Frequently Asked Questions (as of January 2022) – FAQ #2.5, at 5-6 (emphasis added), available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[7] Treas. Reg. 31 CFR 35 at 221, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[8] Id., at 116.

[9] Id., at 178.

[10] Id., at 294.

[11] Department of Treasury, Coronavirus State & Local Fiscal Recovery Funds: Overview of the Final Rule, (as of January 2022), at 18, available at: *SLFRF-Final-Rule-Overview.pdf (treasury.gov).

[12] Id., at 20.

[13] Department of Treasury, Tool for Determining Low and Moderate Income (LMI) Households, available at: SLFRF-LMI-tool.xlsx (live.com).

[14] Coronavirus State and Local Fiscal Recovery Funds, Frequently Asked Questions (as of January 2022), at 1, available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[15] U.S. Department of the Treasury, Statement Regarding Compliance with the Coronavirus State and Local Fiscal Recovery Funds Interim Final Rule and Final Rule, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-Statement.pdf.

Program

COVID-19 Federal Assistance e311Topics

Housing & Rental Assistance, Infrastructure & Maintenance InvestmentsFunding Source

American Rescue Plan Act, CARES Act, FEMAMay a municipality use CRF funds for repairs to buildings used to address the public health impact of COVID-19, e.g., decompression shelters?

As outlined in the U.S. Department of the Treasury’s (“Treasury”) Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”) Final Rule, eligible uses of CSLFRF funds include supporting the COVID-19 public health response[1] through capital investments in public facilities to meet pandemic operational needs.[2] With respect to these eligible uses of CSLFRF funds, the Final Rule specifies that:

Capital expenditures, in certain cases, can be appropriate responses to the public health and economic impacts of the pandemic, in addition to programs and services. Like other eligible uses of [C]SLFRF funds in this category, capital expenditures should be a related and reasonably proportional response to a public health or negative economic impact of the pandemic. The final rule clarifies and expands how [C]SLFRF funds may be used for certain capital expenditures, including criteria and documentation requirements specified in this section, as applicable.[3]

The reopening of a building closed prior to the pandemic, together with capital investments (such as repairs) in the same, may be considered eligible expenses in certain circumstances. Eligibility may, for example, stem from a municipality’s use of the building as a decompression shelter in direct response to the COVID-19 pandemic.[4]

In recognition of the importance of capital expenditures in the COVID-19 public health response, the Final Rule clarifies that the following projects are examples of eligible capital expenditures:

- improvements or construction of COVID-19 testing sites and laboratories, and acquisition of related equipment;

- improvements or construction of COVID-19 vaccination sites;

- improvements or construction of medical facilities generally dedicated to COVID-19 treatment and mitigation (e.g., emergency rooms, intensive care units, telemedicine capabilities for COVID-19 related treatment);

- expenses of establishing temporary medical facilities and other measures to increase COVID-19 treatment capacity, including related construction costs;

- acquisition of equipment for COVID-19 prevention and treatment, including ventilators, ambulances, and other medical or emergency services equipment;

- improvements to or construction of emergency operations centers and acquisition of emergency response equipment (e.g., emergency response radio systems);

- installation and improvements of ventilation systems;

- costs of establishing public health data systems, including technology infrastructure;

- adaptations to congregate living facilities, including skilled nursing facilities, other long-term care facilities, incarceration settings, homeless shelters, residential foster care facilities, residential behavioral health treatment, and other group living facilities, as well as public facilities and schools (excluding construction of new facilities for the purpose of mitigating spread of COVID-19 in the facility); and

- mitigation measures in small businesses, nonprofits, and impacted industries (e.g., developing outdoor spaces).[5]

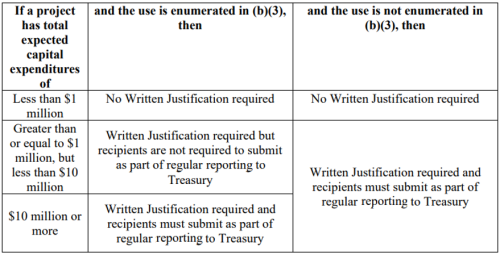

While capital improvement projects designed to alleviate the impacts of the COVID-19 pandemic in a proportional measure can be eligible for CSLFRF funds, Treasury requires the use of funds for certain projects to be supported by a written justification, as outlined in the table below.[6]

If the capital project does require a written justification, the Final Rule requires it to include the following elements:

- Describe the harm or need to be addressed;

- Explain why a capital expenditure is appropriate; and

- Compare the proposed capital expenditure to at least two alternative capital expenditures and demonstrate why the proposed capital expenditure is superior.[7]

Last Revised: February 16, 2022

[1] Treas. Reg. 31 CFR 35 at 54, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] Id., at 60.

[3] Treas. Reg. 31 CFR Part 35, at 192 (emphasis added), available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[4] A decompression shelter is an overflow housing site established to reduce crowding in existing shelters. See Centers for Disease Control and Prevention, Interim Guidance for Homeless Service Providers to Plan and Respond to Coronavirus Disease 2019 (COVID-19), available at: https://www.cdc.gov/coronavirus/2019-ncov/community/homeless-shelters/plan-prepare-respond.html.

[5] Id., at 60-61 (emphasis added).

[6] Id., at 422.

[7] Id.

Program

COVID-19 Federal Assistance e311Topics

Timing of FundsFunding Source

American Rescue Plan Act, CARES Act, FEMA, HUD, Infrastructure Investments and Jobs ActWhat steps should cities take to help minimize the damage of a potential takeback (i.e. a scenario in which a second tranche of ARP funds would be re-allocated to other policy priorities)?

Any takeback of American Rescue Plan Act of 2021 (“ARP”) funds—in which the federal government would hypothetically re-allocate the second tranche of ARP funding towards other priorities—would require new legislation. Neither the text of the ARP nor the U.S. Department of the Treasury (“Treasury”) Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”) Final Rule provide the Secretary of the Treasury with discretion in the distribution of the second tranche of CSLFRF. The ARP states:

The Secretary shall pay to each metropolitan city for which an amount is allocated under paragraph (1), each State for which an amount is allocated under paragraph (2), for distribution to non-entitlement units of local government, and each county for which an amount is allocated under paragraph (3), the Second Tranche Amount for such city, State, or county not earlier than 12 months after the date on which the First Tranche Amount is paid to the city, State, or county.[1]

The Final Rule adds:

[T]he final rule provides that Treasury expects to make all second tranche payments to states available beginning 12 months from the date that funding was first made available by Treasury (May 10, 2021) regardless of when each individual state submitted its initial certification[2]… splitting payments for most states provides consistency with payments to local governments and encourages states to adapt their use of funds to developments that arise in the course of the economic recovery. Moreover, [CSLFRF] funds may be used for costs incurred during the period of performance. Recipients may use their jurisdiction’s budgeting and procurement practices and laws to determine how and when second tranche funds may be obligated.[3]

As the Final Rule explains, the CSLFRF was split into two tranches to enable flexibility for recipients to respond to the impact of the COVID-19 pandemic as it continues to evolve.

To do so, and to lessen the impact of any potential takeback, waiting to allocate or spend the funds contained in the second tranche of CSLFRF would be the most prudent course of action. Additionally, municipalities can plan contingency funding sources for prospective second tranche projects to further reduce the damage of a potential takeback.

However, as noted above, a takeback would be unlikely unless legislation is passed that amends the ARP. However, municipal leaders may consider raising concerns over a possible takeback with their respective Congressional delegations, perhaps in concert with other recipients of CSLFRF.

Section I of the Final Rule discusses remediation and recoupment of ARP funds, but these discussions primarily refer to the process of recouping funds in the event of a violation of law, rather than a takeback of funds.[4]

Information about reducing the risk of a takeback of funds by Treasury (for example, on grounds of improper oversight or accountability) can be found on the Bloomberg Philanthropies site in the response to a question that addresses how cities can increase the likelihood that funds will not be subject to clawbacks.[5]

Last Updated: April 1, 2022

[1] American Rescue Plan Act of 2021 § 9901, Pub. L. No. 117-2, Subtitle M, Section 603b (7)B, amending 42 U.S.C. § 801 et seq., https://www.congress.gov/bill/117th-congress/house-bill/1319/text#HAECAA3A95C4E4FFAB6AA46CE5F9CB2B5.

[2] Treas. Reg. 31 CFR 35 at 350, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[3] Id., at 349.

[4] Treas. Reg. 31 CFR 35 at 374-378, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[5] Bloomberg Cities Network, “What are good practices for documenting and accounting for programs using federal funds?,” available at: https://bloombergcities.jhu.edu/faqs/what-are-good-practices-documenting-and-accounting-programs-using-federal-funds.

Program

COVID-19 Federal Assistance e311Topics

ProcurementsFunding Source

American Rescue Plan Act, CARES Act, FEMA, HUD, Infrastructure Investments and Jobs ActWill there be administrative caps on the use of funds for each procurement? May interdepartmental billings for professional technical services, such as engineering design, be charged to ARP/CLFRF funds. Do they fall within a possible administrative cap?

The U.S. Department of the Treasury (“Treasury”) has not indicated whether there will be administrative caps on the use of Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”). Nor is there Treasury guidance related to interdepartmental billings for professional technical services. There is, however, more general Treasury guidance that municipalities can consider.

Treasury’s Final Rule states that “[2 C.F.R. § 200, the] Administrative requirements, Cost Principles, and Audit Requirements for Federal Awards (commonly called the “Uniform Guidance”) generally applies to CSLFRF funds.”[1] For more details regarding implementation of the Uniform Guidance, please see the following e311 resource:

As of now, Treasury guidance for CSLFRF does not explicitly state that there is a cap on administrative costs, except that most of the provisions of the Uniform Guidance apply to this program, including that such costs must be reasonable and allocable under the Uniform Guidance.[2]

Treasury has indicated that recipients may use CSLFRF funds for: (i) direct costs (“those that are identified specifically as costs of implementing the [CSLFRF] program objectives, such as contract support, materials, and supplies for a project”); and (ii) indirect costs (“general overhead costs of an organization where a portion of such costs are allocable to the [CSLFRF] awards such as the cost of facilities or administrative functions like a director’s office”).[3] Treasury further notes that:

Each category of cost should be treated consistently in like circumstances as direct or indirect, and recipients may not charge the same administrative costs to both direct and indirect cost categories, or to other programs. If a recipient has a current Negotiated Indirect Costs Rate Agreement (NICRA) established with a Federal cognizant agency responsible for reviewing, negotiating, and approving cost allocation plans or indirect cost proposals, then the recipient may use its current NICRA. Alternatively, if the recipient does not have a NICRA, the recipient may elect to use the de minimis rate of 10 percent of the modified total direct costs pursuant to 2 CFR 200.414(f).[4]

With regard to interdepartmental billings for professional technical services, such as engineering design services, these “charge back” type expenses would likely be categorized as direct costs rather than administrative costs and would therefore be built into the overall programmatic budget.

Treasury recently issued additional guidance relative to “pre-project” development costs for water, sewer, and broadband infrastructure projects, and it is illustrative for potential “charge back” costs such as engineering design fees. Specifically:

To determine whether Funds can be used on pre-project development for an eligible water or sewer project, recipients should consult whether the pre-project development use or cost is eligible under the Drinking Water and Clean Water State Revolving Funds (CWSRF and DWSRF, respectively). Generally, the CWSRF and DWSRF often allow for pre-project development costs that are tied to an eligible project, as well as those that are reasonably expected to lead to a project. For example, the DWSRF allows for planning and evaluations uses, as well as numerous pre-project development costs, including costs associated with obtaining project authorization, planning and design, and project start-up like training and warranty for equipment. Likewise, the CWSRF allows for broad pre-project development, including planning and assessment activities, such as cost and effectiveness analyses, water/energy audits and conservation plans, and capital improvement plans. Similarly, pre-project development uses and costs for broadband projects should be tied to an eligible broadband project or reasonably expected to lead to such a project. For example, pre-project costs associated with planning and engineering for an eligible broadband infrastructure build-out is considered an eligible use of funds, as well as technical assistance and evaluations that would reasonably be expected to lead to commencement of an eligible project (e.g., broadband mapping for the purposes of finding an eligible area for investment).[5]

In contrast to potential direct costs described by Treasury, administrative costs include “costs required to administer CSLFRF funds, oversee subrecipients and beneficiaries, and file periodic reports with Treasury.”[6]

Last Updated: March 16, 2022

[1] Treas. Reg. 31 CFR 35 at 171, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] Coronavirus State and Local Fiscal Recovery Funds, Frequently Asked Questions (as of January 2022), – FAQ #9.3, available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[3] Department of Treasury Compliance and Reporting Guidance (State and Local Fiscal Recovery Funds), February 28, 2022, 8, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf.

[4] Id.

[5] Coronavirus State and Local Fiscal Recovery Funds, Frequently Asked Questions (January 2022), – FAQ #6.12, available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[6] Treas. Reg. 31 CFR 35 at 399, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

Program

COVID-19 Federal Assistance e311Topics

Federal Funding StreamsFunding Source

American Rescue Plan Act, CARES Act, FEMAHow does ARP funding correlate with duplication of benefits requirements in FEMA PA funding? For example, can we use FEMA PA funding for vaccinations if it is also an eligible use for other ARP funding streams?

A municipality likely can use Federal Emergency Management Agency (“FEMA”) Public Assistance (“PA”) funds for vaccinations and other eligible emergency protective measures even if those uses are also eligible under the American Rescue Plan Act (“ARP”). However, the FEMA PA fund recipients must “ensur[e] that they do not accept payment for the same item of work twice” [1] from the two programs’ funding streams.

Municipalities that receive federal funding to address the COVID-19 public health emergency should perform due diligence to avoid duplication of benefits (“DOB”) and thoroughly review and follow the guidance at § 312 of The Stafford Act, 42 USC 5155,[2] and 44 CFR § 206.191.[3] DOB occurs if a person, household, business, government, or other entity receives financial assistance from multiple sources for an identical purpose, and the total assistance received for that purpose is more than the total need for assistance. DOB is addressed in greater detail in the following previously published responses:

- What is the definition of duplication of benefits?

- What guidance can you provide regarding the way in which we can avoid duplication of benefits?

In June 2020, FEMA published a Fact Sheet acknowledging overlap between congressionally-authorized pandemic response funding sources at multiple federal agencies, which specifically addresses the overlap of FEMA PA and ARP funding for emergency protective measures.[4] The Fact Sheet explicitly mentions state, local, tribal, and territorial (“SLTT”) government entities and the DOB mandate by stating:

Section 312 of the Stafford Act prohibits all federal agencies from duplicating benefits for disaster relief. Multiple agencies having authority to expend funds for the same purpose is not, by itself, a duplication of benefits under Section 312. However, all federal agencies are prohibited by Section 312 from paying SLTTs for the same work twice. FEMA is coordinating closely with other federal agencies to provide information about the eligible use of various COVID-19 funding resources. Recipients and subrecipients are ultimately responsible for ensuring that they do not accept payment for the same item of work twice. FEMA applicants will certify in the PA application process that assistance is not being duplicated.[5]

Recipients of FEMA PA and ARP funds should diligently track allocations of payments from each funding source and the related expenditures that address the COVID-19 public health emergency to avoid DOB. Further suggestions for tracking multiple revenue streams are included in the following previously published responses:

- How can municipalities manage — and specifically conduct due diligence on — the finances of programs that are the beneficiaries of multiple sources of funding?

- What are some best practices our municipality can undertake to help us recoup reimbursable costs traceable to COVID-19 oversight and compliance?

- What guidance and best practices exist for municipalities when receiving and spending funding for COVID-19 vaccine distributions?

In addition, FEMA explicitly outlines further guidance for maneuvering through different federal funding streams as it relates to PA funds, stating that:

As FEMA continues to coordinate with our federal partners to ensure coordination of funding, we will provide additional guidance to SLTTs for where they can seek funding. If an applicant applies to FEMA for PA funding and then determines it no longer wants the funding for the cost of certain activities from FEMA and will instead seek funding from another federal agency, the applicant should notify FEMA as soon as possible. Applicants should notify FEMA by withdrawing or amending their PA project application if funding has not been awarded yet or request an updated version to amend their PA project if funding has been awarded.[6]

Finally, municipalities should prioritize funds by assessing their relative need for all eligible emergency protective measures. Municipalities should determine the total amount of assistance available for each need, as some funding sources address various needs while others are more specific concerning their eligible use categories. In addition, by reviewing funding source scope and relevant deadlines, municipalities can better align their allocated funding with their needed emergency protective measures.

Last Updated: June 23, 2021

[1] FEMA FACT SHEET: Coronavirus Disease 2019 (COVID-19) Public Health Emergency: Coordinating Public Assistance and Other Sources of Federal Funding, at 1-2, available at: https://www.fema.gov/sites/default/files/2020-07/FEMA-COVID-19_coordinating-public-assistance-and-other-sources-of-federal-funding_07-01-2020.pdf.

[2] ROBERT T. STAFFORD DISASTER RELIEF AND EMERGENCY ASSISTANCE ACT [Public Law 93–288;

Approved May 22, 1974] [As Amended Through P.L. 116–284, Enacted January 1, 2021], available at:

https://www.govinfo.gov/content/pkg/COMPS-2977/pdf/COMPS-2977.pdf

[3] 44 CFR § 206.191, available at: 44 CFR § 206.191 - Duplication of benefits. | CFR | US Law | LII / Legal Information Institute (cornell.edu)

[4] FEMA FACT SHEET: Coronavirus Disease 2019 (COVID-19) Public Health Emergency: Coordinating Public Assistance and Other Sources of Federal Funding, available at: https://www.fema.gov/sites/default/files/2020-07/FEMA-COVID-19_coordinating-public-assistance-and-other-sources-of-federal-funding_07-01-2020.pdf.

[5] Id., at pp. 1-2.

[6] Id. at p. 1.

Program

COVID-19 Federal Assistance e311Topics

Fund Planning & AllocationFunding Source

American Rescue Plan Act, CARES Act, FEMA, HUD, Infrastructure Investments and Jobs ActHow can cities maximize the chances that programs created as a result of recovery funding continue to be sustainable after the end of their funding?

According to the U.S. Department of the Treasury’s (“Treasury”) Final Rule for the American Rescue Plan Act of 2021 (“ARP”) Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”), a recipient may only use funds to cover costs incurred during the period beginning March 3, 2021, and ending December 31, 2024.[1] The period of performance will run until December 31, 2026, which provides recipients additional time to complete projects funded with payments from the CSLFRF.[2] The CSLFRF provide state, local, tribal, and territorial governments with resources to respond to the COVID-19 public health emergency and its negative economic impacts through four categories of eligible uses.[3]

The Final Rule states that “the purpose of the [C]SLFRF funds is to mitigate the fiscal effects stemming from the COVID-19 public health emergency.”[4] One of the central uses of CSLFRF funds is to provide monies to businesses and individuals who suffered financial loss due to the pandemic and to assist in helping them return to pre-pandemic operations. The CSLFRF aims to mitigate the negative impact of the pandemic and provide the funding to better prepare municipalities for future events. These endeavors are largely envisioned as short-term projects, reimbursements, or investments in response to current fiscal challenges and to help communities prepare for the future.

While CSLFRF are approved for use as seed funds for eligible programs or projects that may exist in perpetuity (with the caveat that ARP funds must be expended by December 31, 2026), there is no guarantee that federal funding will be available in the future to sustain a program or project after December 31, 2026.[5] Municipalities should therefore consider how a program created with the intent to operate past that date will be funded through other means. This may be in the form of a tax, line-item budget from general funds, fees, grants, or other funding streams.

It should be noted that additional information may be provided when Treasury issues new Frequently Asked Questions (“FAQs”) specific to the Final Rule, as indicated by the Interim Final Rule FAQs.[6] Treasury also encourages municipalities to consider the guidance issued in the Statement Regarding Compliance with the Coronavirus State and Local Fiscal Recovery Funds Interim Final Rule and Final Rule.[7]

Last Updated: March 2, 2022

[1] Treas. Reg. 31 CFR 35 at 354-355, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] Id., at 357.

[4] Id., at 58.

[5] Id., at 355.

[6] Coronavirus State and Local Fiscal Recovery Funds, Frequently Asked Questions (as of January 2022), at 1, available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[7] U.S. Department of the Treasury, Statement Regarding Compliance with the Coronavirus State and Local Fiscal Recovery Funds Interim Final Rule and Final Rule, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-Statement.pdf.

Is assistance with community college, college tuition or other higher education challenges an eligible use of ARP funds?

The U.S. Department of the Treasury’s (“Treasury”) Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”) Final Rule provides recipients with a flexible approach that sets guidelines on eligible uses of Fiscal Recovery Funds (“FRF”) and affords municipal officials the discretion to direct funds to the eligible uses of greatest need.[1]

The Final Rule focuses on eligible uses of funding to address disparities in early education; postsecondary education is not mentioned. Furthermore, “tuition” is not explicitly defined in the American Rescue Plan Act of 2021 (“ARP”)[2] or the Final Rule. [3]

Though not specifically mentioned, the use of ARP funding for higher education (post-high school) tuition or other costs related to degree completion may align with the “assistance to households” category. According to the eligible uses defined in 35.6(b)(3)(ii)(A),[4] recipients may use funds to respond to the public health emergency or its negative economic impacts, including assistance to households. Assistance to households can include job training and cash transfers from the recipient to individuals, but would require that: (i) a household or population experienced economic harm; (ii) the use of funds is in response to the COVID- 19 public health emergency; and (iii) the amount is not grossly in excess of the amount needed to address the negative economic impact identified by the recipient.[5]

As described in both the legislation and the Final Rule, a recipient may apply ARP funds to four categories of use, one of which is “the provision of government services to the extent of the reduction in revenue due to the COVID–19 public health emergency.”[6]

Treasury has defined “government services” as:

includ[ing], but…not limited to, maintenance or pay-go funded building of infrastructure, including roads; modernization of cybersecurity, including hardware, software, and protection of critical infrastructure; health services; environmental remediation; school or educational services; and the provision of police, fire, and other public safety services. [7]

If a recipient chooses to apply ARP funds to post-high school programs, the recipient likely will need to tie its use of ARP funds to the provision of government services and to the extent of revenue reduction of the recipient due to the public health emergency.[8] For example, if a community college, as a government service, is determined to be a municipality’s area of greatest need, then the use of ARP funds for that college would require demonstrating a nexus to the municipality’s reduced revenue calculations. Treasury’s guidance addresses how recipients can calculate the extent of the reduction in their general revenue.[9]

Other forms of funding may be explored to provide assistance with community college, college tuition, and higher education funding. For instance, in May 2021, the Department of Education announced the Higher Education Emergency Relief Fund (“HEERF”) and $36 billion in funds made available for emergency aid to public and private nonprofit institutions, as well as $396 million made available to proprietary colleges to serve students and ensure that learning continued during the COVID-19 pandemic.[10]

On January 31, 2022, the Department of Education announced an additional $198 million in new awards as Supplemental Support under the ARP. The Supplemental Support is offered to public and private nonprofit institutions for the purpose of assisting students who did not receive allocations under HEERF:

The SSARP Program assists public and private nonprofit institutions that have the greatest unmet need related to the coronavirus, as determined by the secretary after allocating available funds under HEERF III, including institutions with large populations of graduate students who otherwise did not receive a HEERF allocation under the American Rescue Plan Act, 2021. The Department urges institutions applying for the SSARP program to continue to use the funds to support campuses and students as they deal with the immediate challenges posed by the pandemic.[11]

Additional information addressing elements of Treasury’s recent guidance on using ARP funds for educational programs can be found in the following Bloomberg Federal Assistance e311 Q&A.[12]

Last Updated: February 16, 2022

[1] Treas. Reg 31 CFR 35 at 4, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] American Rescue Plan Act (H.R.1319, 117th Cong. § 9901 (amending 42 U.S.C § 801 et seq., at § 603)), available at: https://www.congress.gov/bill/117th-congress/house-bill/1319/text.

[3] Treas. Reg. 31 CFR 35, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[4] Id., at 418.

[5] Id., at 21-22.

[6] Id., at 233.

[7] Id., at 260.

[8] Id., at 261.

[9] Id., at 318.

[10] U.S. Department of Education, HEERF III

[11] Id.

[12] Bloomberg Cities Network, “Can municipalities use ARP funds to fund educational programs (e.g., Pre-K classrooms or gun violence prevention programs)?”, available at: https://bloombergcities.jhu.edu/faqs/can-municipalities-use-arp-funds-fund-educational-programs-eg-pre-k-classrooms-or-gun-violence.

Program

COVID-19 Federal Assistance e311Topics

Housing & Rental AssistanceFunding Source

American Rescue Plan Act, CARES Act, FEMA, HUDWhat steps can a municipality take to increase participation and expedite spending of rental assistance funds?

The Consolidated Appropriations Act, 2021 states that, beginning on September 30, 2021, the U.S. Department of Treasury (“Treasury”) will recoup funds not spent by Emergency Rental Assistance Program (“ERA”) grantees and reallocate those funds to entities that have spent at least 65 percent of their primary allocation.[1] Eligible grantees that receive payments under this reallocation provision will have those funds available through December 31, 2021, but may request an extension of up to 90 days beyond that date, subject to approval by the Treasury Secretary.[2]

There are many steps a municipality can take to improve the chances of meeting the spending deadlines imposed by the ERA. Some strategies that an eligible grantee may consider include:

- ERA guidelines do not impose on grantees an onerous process of gathering documentation to meet the verification requirements, and in fact are flexible enough to allow attestations.[3] A municipality can increase participation in the ERA by making the relevant populace aware that self-attestations are acceptable and can meet the requisite showing of financial hardship and housing instability.[4] Examples of a tenant’s self-attestation are listed below.

- I am the tenant identified above and the rental property for which I am applying for assistance is my primary residence.

- At least one (1) individual in my household has (i) qualified for unemployment benefits or (ii) experienced a reduction in income, incurred significant costs, or experienced other financial hardship due directly or indirectly to COVID-19.

- My household is at a risk of homelessness or housing instability.

- My household income has been reported truthfully and accurately.

- I have not received and am not aware of any duplicative benefit from another funding source. Note that if the tenant does not possess a written lease, the ERA guidelines allow for a landlord or management agent to submit an attestation to meet this requirement.[5]

- Municipalities may pay tenants directly where either the landlord or the utility provider is nonresponsive or uncooperative.[6] Under the U.S. Department of Treasury’s (“Treasury”) May 7, 2021, Frequently Asked Questions (“FAQs”), it allows municipalities to make the determination regarding a nonresponsive or uncooperative landlord or utility provider in as few as 5 calendar days if at least 3 prior attempts at contact made via either phone, text or email are unsuccessful.[7]

- If the municipality has reliable workforce data that includes income information, it can consider using that data to validate Area Median Income (“AMI”) and/or financial hardship requirements. The data could be used to demonstrate a decline in income over a period of time.[8] Similarly, if data exists for another program with established income requirements, municipalities can consider using this data to validate AMI. For example, if a household must be at or below 80% AMI in order to qualify for the Supplemental Nutrition Assistance Program (“SNAP”) then the income requirement for a household applying for ERA should be able to be validated by showing that household’s receipt of SNAP benefits.

- Here are some additional suggestions to maximize participation:

- Partner with nonprofits to reach segments of the population or residents in certain geographical areas who may face challenges in completing timely and accurate online applications.[9] Nonprofits can be authorized to assist applicants in the application process.

- Establish a centralized call center to communicate directly with potential applicants and take application information over the phone.

On June 24, 2021, Treasury released additional FAQs. FAQ 37 encourages grantees to “address barriers that potentially eligible households may experience in accessing ERA programs, including by providing program documents in multiple languages and by conducting targeted outreach to populations with disproportionately high levels of unemployment or housing instability or that are low income. Grantees should also provide, either directly or through partner organizations, culturally and linguistically relevant outreach and housing stability services to ensure access to assistance for all eligible households.”[10]

FAQ 38 indicates that grantees may obtain information in bulk from utility providers and landlords with multiple units regarding the eligibility of multiple tenants, or bundle assistance payments for the benefit of multiple tenants in a single payment to a utility provider or landlord.[11] Such data-sharing agreements between grantees and utility providers or landlords with multiple units may reduce administrative burdens and enhance program integrity by providing information to validate tenant-provided information.[12] We recommend a close read of the relevant FAQ’s above.

These allowances may serve as helpful strategies for grantees to take in order to raise participation and increase expenditures for Rental Assistance.

Additional resources and strategies on how to spend down Emergency Rental Assistance Program funds before the upcoming deadline are available from Local Housing Solutions' Emergency Rental Assistance Program and National Low Income Housing Coalition's Resource Hub.

Last Updated: June 22, 2021

[1] Consolidated Appropriations Act, 2021 (Pub. L. 116-260), Division N, Title V, Subtitle A, Section 501(d), available at: https://www.congress.gov/116/cprt/HPRT42770/CPRT-116HPRT42770.pdf.

[2] Id. at Section 501(e).

[3] U.S. Department of the Treasury Emergency Rental Assistance Program, Frequently Asked Questions (as of May 7, 2021) – FAQ #1, at 2, available at: https://home.treasury.gov/system/files/136/ERA2FAQs%205-6-21.pdf.

[4] Id. at FAQ #2, at 3.

[5] Id. at FAQ #5, at 5.

[6] Id. at FAQ #12, at 7.

[7] Id. at FAQ #12, at 8.

[8] Id. at FAQ #4, at 4.

[9]Id. at FAQ #21, at 11.

[10] U.S. Department of the Treasury Emergency Rental Assistance Program, Frequently Asked Questions (as of June 24, 2021) – FAQ #37, at 15, available at: https://home.treasury.gov/system/files/136/ERA_FAQs_6-24-21.pdf.

[11] Id. at FAQ #38, at 16.

[12] Id.

Program

COVID-19 Federal Assistance e311Topics

Lost Revenue & Revenue ReplacementFunding Source

American Rescue Plan ActWhen should a municipality calculate revenue loss and how does that calculation impact the ability to use ARP funds?

Based on the U.S. Department of the Treasury’s (“Treasury”) guidance, the calculation of revenue loss is not a requirement for municipalities to apply for and receive their allocation of Coronavirus Local Fiscal Recovery Funds (“CLFRF”) pursuant to the American Rescue Plan Act of 2021 (“ARP”) funding. CLFRF authorizes $130.2 billion for use by metropolitan cities, non-entitlement units of local government, and counties. The calculation of revenue loss (or lack thereof) does not impact the overall amount of funding.

Treasury’s Final Rule offers a standard allowance for revenue loss of $10 million, allowing recipients to select between a standard amount of revenue loss or complete a full revenue loss calculation. Recipients that select the standard allowance may use that amount for the provision of government services.[1]

According to Treasury guidance, recipients may calculate revenue loss at four distinct points in time, either at the end of each calendar year (e.g., December 31 for years 2020, 2021, 2022, and 2023) or the end of each fiscal year of the recipient. Under the flexibility provided in the Final Rule, recipients can choose whether to use calendar or fiscal year dates but must be consistent throughout the period of performance.[2]

Municipalities that do not calculate revenue loss will be allowed to select a standard allowance of $10 million to use for the provision of government services. This option provides municipalities with the “flexibility to use minimal administrative capacity on the calculation.”[3]

Last Updated: January 28, 2022

[1] Treas. Reg. 31 CFR 35 at 7, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] U.S. Department of the Treasury Coronavirus State & Local Fiscal Recovery Funds: Overview of the Final Rule, at 9, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule-Overview.pdf.

[3] Treas. Reg. 31 CFR 35 at 392, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.