Program

COVID-19 Federal Assistance e311Topics

Due Diligence & Fraud ProtectionFunding Source

American Rescue Plan Act, CARES Act, FEMA, HUD, Infrastructure Investments and Jobs ActWhat good practices can municipalities follow to minimize duplicative work and stay current with changing reporting requirements?

There are many good practices for municipalities to implement to ensure they minimize duplicative work and stay current with reporting requirements for both the American Rescue Plan Act’s (“ARP”) Coronavirus State and Local Fiscal Recovery Fund (“CSLFRF”) and the Coronavirus Aid Relief and Economic Security Act’s (“CARES Act”) Coronavirus Relief Fund (“CRF”).[1]

First, municipalities should choose to designate representatives who can: (i) track deadlines; (ii) monitor newly published guidance and regulations; and (iii) share the relevant information with internal representatives and external stakeholders. The U.S. Department of the Treasury (“Treasury”) has published information relating specifically to CSLFRF “Recipient Compliance and Reporting Responsibilities” on its website.[2]

To ensure compliance with the reporting guidance discussed further below, municipalities should: (i) review their procurement procedures to ensure compliance with federal and other relevant mandates; (ii) take steps to ensure compliance with relevant documentation mandates; and (iii) implement ongoing training to facilitate compliance with the numerous applicable federal, state, and local mandates.

Documentation

Reporting requirements for federal grants have many similarities, including quarterly expenditure reports and detailed procurement processes. The CSLFRF and the CRF vary in their respective reporting requirements.

Reporting obligations for the CRF are detailed in a memorandum prepared by the Treasury Office of Inspector General (“OIG”).[3] Pursuant to CSLFRF, municipalities must provide quarterly project and expenditure reports relating to their use of CSLFRF funds.[4] CSLFRF reporting obligations are also reported in the Interim Final Rule,[5] the Final Rule,[6] and several of Treasury’s Frequently Asked Questions (“FAQs”) relating to the CSLFRF.[7]

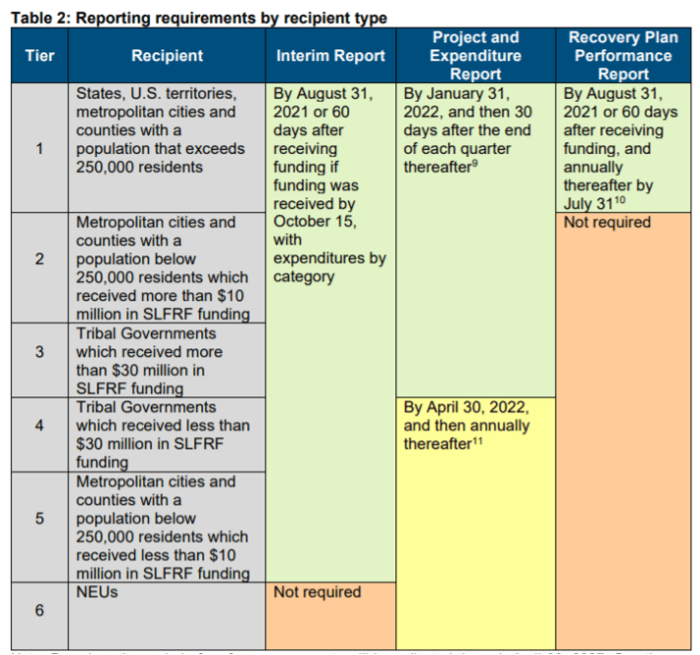

The below chart provides important information about Treasury reporting deadlines for recipients of CSLFRF.[8]

In order to assist municipalities in submitting the Project and Expenditure Report due on January 31, 2022, and subsequent Recovery Plan Performance Reports, Treasury published the following information:

- Recipient Reporting User Guide, to assist municipalities with the submission of the Recovery Plan Performance Reports.[9]

- Recovery Plan Performance Report Template, posted on Treasury’s Recipient Compliance and Reporting Guidance webpage.

- CSLFRF Compliance and Reporting Guidance, which provides details and clarification for each recipient’s compliance and reporting responsibilities.[10]

Municipalities should stay up-to-date on guidance and FAQs published by Treasury and other federal agencies, including changes to the reporting requirements. For the CSLFRF programs, municipalities can stay current by registering on Treasury’s website[11] to receive email updates on changes to the FAQs.

Below are examples of additional guidance and published FAQs that are helpful in understanding reporting and documentation requirements:

- July 19, 2021, Treasury Coronavirus State and Local Fiscal Recovery Funds Frequently Asked Questions[12]

- April 19, 2021, Treasury Office of Inspector General - Coronavirus Relief Fund Prime Recipient Quarterly GrantSolutions Submissions Monitoring and Review Procedure Guide[13]

- March 10, 2021, Treasury Interim Final Rule, Section VIII “Reporting”[14]

- March 2, 2021, Office of Inspector General Coronavirus Relief Fund Frequently Asked Questions Related to Reporting and Recordkeeping[15]

- July 2, 2020, Treasury Office of Inspector General - Coronavirus Relief Fund Reporting and Record Retention Requirements[16]

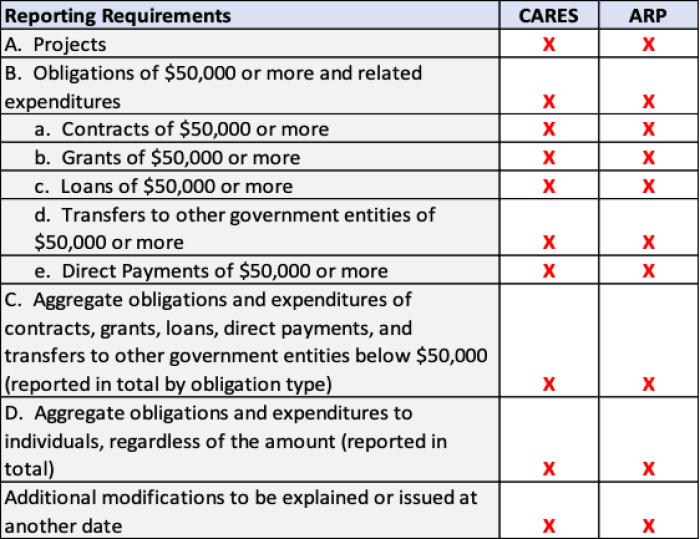

The table below shows many of the overlapping reporting requirements for the CARES Act[17] and ARP[18] that municipalities must provide in quarterly reports.[19]

Although municipalities are required to report similar information for both funding sources, records should be maintained separately, and attention should be given to the good practices described below for documenting the projects and expenditure reports. Adhering to good practices in documenting the information for use in CRF and CSLFRF reports will help facilitate transparency and proper accounting for expenditures. Robust documentation will also help prepare the municipality for any additional city, state, or federal reporting obligations or audits.

In April 2021, the Federal Emergency Management Agency (“FEMA”) released a fact sheet on Audit-Related Guidance for Entities Receiving FEMA Public Assistance Funds.[20] Following these recommendations can help municipalities meet federal reporting requirements as well as other reporting requirements that may be required by municipalities or states. The recommendations require a municipality to::

- Designate a person to coordinate the accumulation of records (e.g., receipts, invoices, etc.).

- Establish a separate and distinct account for recording revenue and expenditures and a separate identifier for each distinct FEMA project.

- This process can also be used for separating CRF and CSLFRF funds and the individual projects within each.

- Ensure that the final expenditures for each project are supported by the dollar amounts recorded within the accounting system of record.

- Ensure that each expenditure is recorded and linked to supporting documentation (e.g., checks, invoices, etc.) that can be easily retrieved.

- Ensure that expenditures claimed are necessary to respond to the COVID-19 pandemic, reasonably pursuant to federal regulations and federal cost principles and conform to standard program eligibility and other federal requirements.[21]

Additional steps that a municipality may consider in helping to manage the similar reporting requirements of the two programs:

- Implement a uniform reporting format for both CRF funds and CSLFRF funds to allow for easy data transference between sub-recipient and prime recipient and between prime recipient and reporting platform.

- Prepare project documents as if already under audit by creating an audit trail that a municipality will be able to rely on should an audit happen immediately. The audit trail should include, but not necessarily be limited to, general ledgers that account for the receipt and disbursement of funds, budget records for 2019, 2020, and 2021 payroll records to support payroll expenses related to COVID-19, contracts and subcontracts, and, where applicable, photographs supporting expenditures.

- Leverage technology solutions to generate multiple reports with the same data points for various governing entities, where applicable.

- Continually audit project documents for accuracy and adherence to reporting guidelines.

- Ensure that both prime recipient and sub-recipients have valid DUNS numbers and have active SAM registrations to minimize reporting time.

- According to OIG-CA-21-020 (“American Rescue Plan – Application of Lessons Learned from the Coronavirus Relief Fund”), issued by the Treasury on May 10, 2021, “Treasury officials are considering various software options for ARP recipient reporting and administration, including GrantSolutions and Salesforce.”[22]

- Municipalities can prepare for CSLFRF reporting by ensuring that those expected to receive this assistance are registered with SAM and have valid DUNS numbers.

Resources such as Bloomberg’s COVID e311 repository[23] provide additional information on updated timelines, requirements, and comparisons for documentation overlap between CARES and ARP. Some examples include:

- What are good practices for documenting and accounting for programs using federal funds? | Bloomberg Cities (jhu.edu)

- What documentation is a municipality required to supply in order to receive funds? What is the due date for the documentation? | Bloomberg Cities (jhu.edu)

- How are reporting requirements impacted by a city’s fiscal calendar? | Bloomberg Cities (jhu.edu)

To facilitate documentation accuracy, municipalities should consider implementing a robust policy or decision checklist to ensure that eligible expenses meet the definitions of use by the particular grant/award. It may be helpful for multiple personnel to participate in the evaluation process, using the same criteria as provided by each funding type, to confirm that the expenses meet the outlined priorities of the federal funds.

Procurement Processes

Substantial federal guidance is available regarding the procurement process and requirements. First, municipalities should review the eligible and ineligible uses of ARP funds published in the Final Rule.[24] Second, the FEMA “Top 10 Procurement under Grants Mistakes” highlights key risks applicable to all contracting using federal grant assistance.[25] Third, 2 CFR Part 200 contains mandates relating to Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards.[26] 2 CFR Part 200 provides recipients with mandates relating to the use of federal grant assistance. The mandates of this regulation are also addressed in Part 1(D) of Treasury’s Compliance and Reporting Guidance.[27] 2 CFR 200 applies to all federal programs; therefore, recipients should be familiar with it.

Fourth, just as the federal government details procurement processes, each government entity (such as a municipality) or other recipients or subrecipients of CSLFRF assistance should have written policies delineating required steps for contracting. In some cases, municipalities may find it prudent or expedient to mirror state processes. If there are no standardized written procurement policies at the municipal level, the adoption of state rules can help municipalities implement proper procurement procedures for the use of CSLFRF assistance. Strict compliance with local, state, and federal procurement requirements will reduce the risk of future negative audit findings.

Non-Entitlement Units (“NEUs”) are local governments typically serving a population under 50,000. For NEUs requesting CSLFRF funding, the Treasury Checklist for Requesting Initial Payment[28] includes general “After Requesting Funding”[29] information that may assist the planning process even before spending begins.

Municipalities can also use resources such as the FEMA Fact Sheet[30] for guidance on preparatory steps and best practices designed to “overlay” applicable state and municipal procurement practices onto the federal procurement rules for these funds.

Ongoing Training

While procurement processes and documentation requirements target a particular grant's objectives and eligible expenses, financial management training can help improve government operations. In addition to educating employees on specific provisions of the CSLFRF and CRF, municipalities can also use learning opportunities to develop skills and preparedness for general disaster recovery and related funding procedures. Various topics are offered via online self-study and in classroom settings, all tailored to fit the post-pandemic work environment. Types of training that improve general operations and are not strictly related to COVID-19 funding include:

- fraud awareness;

- grant program-specific training;

- electronic portal training specific to federal program;

- intra-agency working groups; and

- technology solutions that would help financial tracking and documentation management.

The FEMA National Preparedness Course Catalog can be searched to identify relevant trainings or courses that may be beneficial to municipalities.[31]

Certain federal government departments and regional offices that oversee programs like the CRF and CSLFRF, as well as FEMA’s Public Assistance (“PA”) and Hazard Mitigation Grant Program (“HMGP”) also provide free trainings. Training modules should be scheduled as reporting requirements change to ensure all employees responsible for such programs are notified of changes and can adapt programs as needed.

Recipients should regularly check the following agency pages to find out when technical assistance webinars are being scheduled:

- Department of Treasury CSLFRF

- Department of Treasury Emergency Rental Assistance Program

- FEMA PA for COVID-19

- FEMA HMGP:

Furthermore, some national, non-governmental organizations provide training and educational resource libraries on various aspects of CRF and CSLFRF funding for both states and municipalities:

- The United States Conference of Mayors: Organization of cities with populations of 30,000 or more. The conference and its members (elected mayors) develop policies and programs that collectively represent the views of members. Resources and programs are available on their website, including a dedicated section on COVID-19 issues and ARP Resources for cities.[32]

- National Association of Counties (“NACo”): Serves nearly 40,000 county elected officials and 3.6 million county employees through membership services, including education and events.[33] On-demand educational series include “Understanding Eligible Uses of the Fiscal Recovery Fund.”[34]

- National League of Cities (“NLC”): Serves more than 2,000 cities across the United States and has a dedicated library of over 100 COVID-19 related resources including a forum to connect with other cities, FAQ forms, and webinars on updates to Treasury guidance.[35]

- National Association of State Budget Officers (“NASBO”): Monitors budget and financial implications related to COVID-19 and provides weekly updates in their Washington Report e-publication.[36] Municipal officials can subscribe to the Washington Report for weekly updates on financial and budgetary details of ARP and other COVID-19-related funding questions.[37]

- National Governors Association (“NGA”): Represents leaders from 55 states, territories, and commonwealths and provides dedicated COVID-19 updates on their website.[38] Resources include an ARP eligibility guide, webinars, and publications.[39]

- National Association of State Auditors, Comptrollers, and Treasurers (“NASACT”): Works to address government financial management issues and has a dedicated COVID-19 resource library for state governments.[40]

- National Conference of State Legislatures (“NCSL”): Aims to facilitate exchange of information between legislatures in states, territories, and commonwealths and provides a dedicated COVID-19 database of resources for states.[41] The fiscal section in the database includes a state-by-state breakdown of ARP funding.[42]

- Government Finance Officers Association (“GFOA”): Represents public finance officials throughout the United States and hosts weekly educational events and webinars to educate municipal officials on Treasury updates and other government finance topics.[43] Additionally, GFOA provides a Coronavirus Response Resource Center with information on the CARES Act and CSLFRF.[44]

- National Emergency Management Association (“NEMA”): Supports the professionalization of emergency management and aims to strengthen the nation’s emergency management system.[45]

Last Revised: January 31, 2022

[1] American Rescue Plan Act of 2021 § 9901, Pub. L. No. 117-2, amending 42 U.S.C. § 801 et seq., available at: https://www.congress.gov/bill/117th-congress/house-bill/1319/text#HAECAA3A95C4E4FFAB6AA46CE5F9CB2B5. See also Coronavirus Aid, Relief, Economic Security Act (CARES Act), Pub. L. No. 116–136, 134 Stat. 281 (2020), available at: https://www.congress.gov/bill/116th-congress/house-bill/748/text.\.

[2] U.S. Department of the Treasury, Recipient Compliance and Reporting Responsibilities, available at: https://home.treasury.gov/policy-issues/coronavirus/assistance-for-state-local-and-tribal-governments/state-and-local-fiscal-recovery-funds/recipient-compliance-and-reporting-responsibilities.

[3] U.S. Department of the Treasury Office of Inspector General, “Memorandum for Coronavirus Relief Fund Recipients”, July 2, 2020, 1-3, https://home.treasury.gov/system/files/136/IG-Coronavirus-Relief-Fund-Recipient-Reporting-Record-Keeping-Requirements.pdf.

[4] U.S. Department of Treasury, Coronavirus State and Local Fiscal Recovery Funds—Compliance and Reporting Guidance, Version, 2.1, November 15, 2021, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf. See also U.S. Department of the Treasury, Treasury’s Portal for Recipient Reporting, State and Local Fiscal Recovery Funds, available at: https://home.treasury.gov/system/files/136/SLFRF_Treasury-Portal-Recipient-Reporting-User-Guide.pdf.

[5] Treas. Reg. 31 CFR Part 35 at 110-112, available at: https://home.treasury.gov/system/files/136/FRF-Interim-Final-Rule.pdf.

[6] Treas. Reg.31 CFR Part 35, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[7] Coronavirus State and Local Fiscal Recovery Funds Frequently Asked Questions (as of July 19, 2021), at 34-37, available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[8] U.S. Department of Treasury, Coronavirus State and Local Fiscal Recovery Funds—Compliance and Reporting Guidance, Version, 2.1, November 15, 2021, at 13, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf.

[9] U.S. Department of the Treasury, Treasury’s Portal for Recipient Reporting, August 9, 2021, available at https://home.treasury.gov/system/files/136/SLFRF_Treasury-Portal-Recipient-Reporting-User-Guide.pdf.

[10] U. S. Department of Treasury, Coronavirus State and Local Fiscal Recovery Funds—Compliance and Reporting Guidance, Version, 2.1, November 15, 2021, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf.

[12] Coronavirus State and Local Fiscal Recovery Funds Frequently Asked Questions (as of July 19, 2021), available at: https://home.treasury.gov/system/files/136/SLFRPFAQ.pdf.

[13] Coronavirus Relief Fund Prime Recipient Quarterly GrantSolutions Submissions Monitoring and Review Procedure Guide, April 19, 2021, available at: https://oig.treasury.gov/sites/oig/files/2021-04/OIG-CA-20-029R.pdf.

[14] Treas. Reg. 31 CFR 35 at 110-112, available at: https://home.treasury.gov/system/files/136/FRF-Interim-Final-Rule.pdf.

[15] Treasury Office of Inspector General, Coronavirus Relief Fund Frequently Asked Questions Related to Reporting and Recordkeeping, March 2, 2021, available at: https://bfm.sd.gov/covid/OIG_CRF_FAQ_20210302.pdf.

[16] Treasury Office of Inspector General, Coronavirus Relief Fund Reporting and Record Retention Requirements, July 2, 2020, available at: https://oig.treasury.gov/sites/oig/files/2021-01/OIG-CA-20-021.pdf.

[17] U.S. Department of the Treasury, Department of the Treasury Office of Inspector General Coronavirus Relief Fund Frequently Asked Questions Related to Reporting and Recordkeeping (Revised), March 2, 2021, at Question #40, at 10-11, available at: https://bfm.sd.gov/covid/OIG_CRF_FAQ_20210302.pdf.

[18] Treas. Reg. 31 CFR 35 at 110-112, available at: https://home.treasury.gov/system/files/136/FRF-Interim-Final-Rule.pdf.

[19] Note that according to the Treasury Interim Final Rule, pg. 111, aside from quarterly reports, each municipality that is not considered a “nonentitlement unit of local government” will have to provide an interim report from the date of award to July 31, 2021. Nonentitlement units of local governments are required to provide Project and Expenditure annual reports rather than quarterly reports. These reports follow the same guidelines as in the table below.

[20] FEMA, Audit-Related Guidance for Entities Receiving FEMA Public Assistance Funds, April 6, 2021, available at: https://www.fema.gov/sites/default/files/documents/fema_audit-related-guidance-entities-receiving_public-assistance_4-6-2021.pdf.

[21] Id., at 1-2.

[22] U.S. Department of the Treasury, OIG-CA-21-2020, American Rescue Plan – Application of Lessons Learned from the Coronavirus Relief Fund, May 17, 2021, at 6, available at: https://oig.treasury.gov/sites/oig/files/2021-05/OIG-CA-21-020.pdf.

[23] Bloomberg Cities Network, “Federal Assistance e311 Knowledge Base,” available at: https://bloombergcities.jhu.edu/program/e311/knowledge-base.

[24] Treas. Reg. 31 CFR 35 at 138-145, available at: https://home.treasury.gov/system/files/136/FRF-Interim-Final-Rule.pdf ; Treas. Reg. 31 CFR 35 at 12, available at https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf ; U.S. Department of the Treasury, Coronavirus State and Local Fiscal Recovery Funds Fact Sheet as of May 10, 2021, at 2-8, available at: https://home.treasury.gov/system/files/136/SLFRP-Fact-Sheet-FINAL1-508A.pdf; 31 CFR Part 35, Final Rule, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[25] FEMA, Top Ten Procurement under Grants Mistakes, available at: https://www.fema.gov/sites/default/files/2020-08/fema_top-10-mistakes_flyer.pdf.

[26] 2 CFR § 200, available at: https://www.law.cornell.edu/cfr/text/2/part-200.

[27] U.S. Department of the Treasury, Coronavirus State and Local Fiscal Recovery Funds—Compliance and Reporting Guidance, Version, 2.1, November 15, 2021, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf.

[28] U.S. Department of the Treasury, Coronavirus Local Fiscal Recovery Fund: Non-entitlement Unit of Local Government Checklist for Requesting Initial Payment, available at: https://home.treasury.gov/system/files/136/NEU_Checklist_for_Requesting_Initial_Payment.pdf.

[29] Id.

[30] FEMA, Audit-Related Guidance for Entities Receiving FEMA Public Assistance Funds, April 6, 2021, available at: https://www.fema.gov/sites/default/files/documents/fema_audit-related-guidance-entities-receiving_public-assistance_4-6-2021.pdf.

[31] FEMA, National Preparedness Course Catalog, available at: https://www.firstrespondertraining.gov/frts/npccatalog?catalog=EMI.

[32] The United States Conference of Mayors, COVID-19: What Mayors Need to Know, available at: https://www.usmayors.org/issues/covid-19/.

[33] National Association of Counties, NACo Knowledge Network, available at: https://www.naco.org/education-events#on-demand.

[34] Id.

[35] National League of Cities, Resource Library, available at: https://www.nlc.org/resources-training/resource-library/?orderby=date&topic%5B%5D=covid-19.

[36] National Association of State Budget Officers, COVID-19 Relief Funds Guidance and Resources, available at: https://www.nasbo.org/mainsite/resources/covid-19-relief-funds-guidance-and-resources.

[37] National Association of State Budget Officers, Washington Report, available at: https://www.nasbo.org/resources/e-publications/washington-report.

[38] National Governors Association, COVID-19: What you need to know, available at: https://www.nga.org/coronavirus/.

[39] National Governors Association, NGA Issue Library, available at: https://www.nga.org/library/?tx_post_tag=coronavirus-posts.

[40] National Association of State Auditors, Comptrollers, and Treasurers, COVID-19 Resources for States, available at: https://www.nasact.org/covid_19_resources_for_states.

[41] National Conference of State Legislatures, NCSL Coronavirus (COVID-19) Resources for States, available at: https://www.ncsl.org/research/health/ncsl-coronavirus-covid-19-resources.aspx.

[42] Id.

[43] Government Finance Officers Association, Events Calendar, available at: https://www.gfoa.org/events.

[44] Government Finance Officers Association, Coronavirus Response Resource Center, available at: https://www.gfoa.org/coronavirus.

[45] National Emergency Management Association, NEMA Resources, available at: https://www.nemaweb.org/index.php/resources#webinars.