Program

COVID-19 Federal Assistance e311Topics

Due Diligence & Fraud ProtectionFunding Source

American Rescue Plan ActWhat documentation is a municipality required to supply in order to receive funds? What is the due date for the documentation?

Pursuant to its commitment to providing guidance and instructions on the reporting requirements,[1] on November 15, 2021, the United States Department of the Treasury (“Treasury”) published Version 2.1 of the Compliance and Reporting Guidance (“Reporting Guidance”) for CSLFRF.[2] The Reporting Guidance clarifies the compliance responsibilities of CSLFRF recipients and lists three reports that recipients may need to provide by specified deadlines, namely:

- Interim Report: “Provides an initial overview of status and uses of funding. This is a one-time report.”

- Project and Expenditure Report: “Report on projects funded, expenditures, and contracts and subawards over $50,000, among other information.”

- Recovery Plan Performance Report: “The Recovery Plan Performance Report (“Recovery Plan”) will provide information on the projects that large recipients are undertaking with program funding and how they plan to ensure program outcomes are achieved in an effective, efficient, and equitable manner. It will include key performance indicators identified by the recipient and some mandatory indicators identified by Treasury. The Recovery Plan will be posted on the website of the recipient as well as provided to Treasury.”[3]

Recipients will submit required reports via the Treasury Reporting CSLFRF portal.[4] On August 9, 2021, Treasury published updated guidance on submitting reports via the Portal, including the policy and technical requirements for entering information.[5]

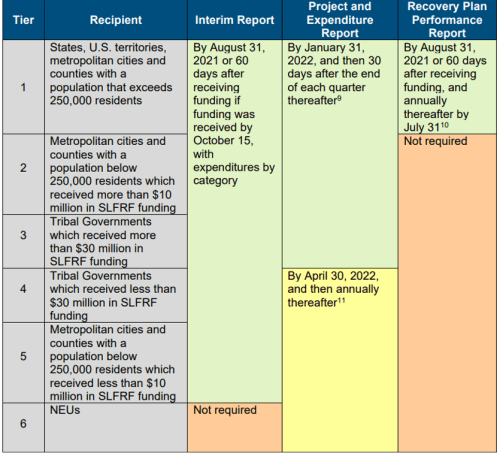

Treasury’s Reporting Guidance currently includes a graphic, including due dates, describing reporting requirements for three reports, delineated by CSLFRF recipient type as follows:[6]

The Reporting Guidance sets a deadline of August 31, 2021, for recipients to provide the one-time Interim Report on CSLFRF expenditures and obligations; this deadline applies to states, U.S. territories, metropolitan cities, counties, and Tribal governments (recipients other than Non-Entitlement Units of Local Government (“NEUs”)).[7] If funding was received after October 15, 2021, the Interim Report may be submitted 60 days after receiving funds. The Interim Report must reflect a recipient’s expenditures and obligations from the date of award to July 31, 2021, broken down by Expenditure Category (which can be selected from a menu of available options on the CSLFRF portal).[8] For purposes of reporting in the CSLFRF portal, an “expenditure” is an amount incurred as a liability of the entity (e.g., the service has been rendered or the good has been delivered to the entity),[9] and an “obligation” encompasses orders placed for property and services, contracts and subawards made, and similar transactions that require payment.[10] Appendix 1 of the Reporting Guidance contains the Expenditure Categories list.[11]

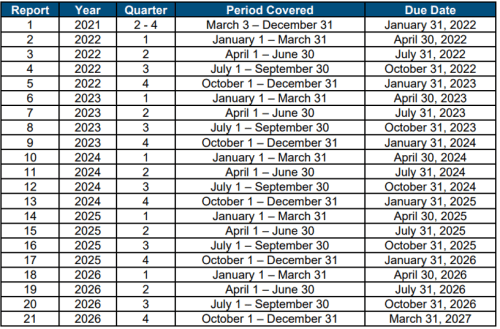

Treasury also establishes a requirement for Project and Expenditure Reports. The information required for these reports includes information regarding Projects, Expenditures, Project Status, Project Demographic Distribution, Subawards, Civil Rights Compliance, Programmatic Data, and NEU Distributions.[12] Additional information requirements are found on pages 14 to 22 of the Reporting Guidance. For all Tribal Governments that received over $30 million, as well as states, U.S. territories, and metropolitan cities and counties that either (1) have a population that exceeds 250,000 residents or (2) have fewer than 250,000 residents but received more than $10 million in CSLFRF funding, the first report is due January 31, 2022, and subsequent reports are to be filed quarterly as follows:[13]

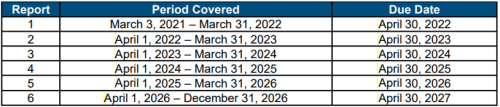

For NEUs, Tribal Governments that received less than $30 million in CSLR, and metropolitan cities and counties with populations lower than 250,000 residents and that receive less than $10 million in CSLFRF, the second Project and Expenditure Report is due April 30, 2022, and subsequent reports are due annually thereafter,[14] as follows:

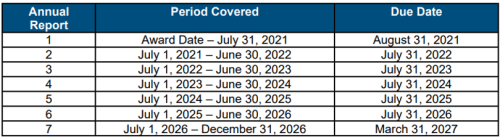

Treasury also requires states, U.S. territories, metropolitan cities, and counties with more than 250,000 residents to submit Recovery Plan Performance Reports and to post copies to the entity’s website by August 31, 2021, and annually thereafter. This report will provide the public and Treasury with information on the recipient’s planned and ongoing projects funded by its CSLFRF allocation and describe the recipient’s plans to achieve program outcomes effectively, efficiently, and equitably.[15] The first report will cover the period ending July 31, 2021. Treasury sets the following timeline for the submission of Recovery Plan Performance Reports:[16]

On November 5, 2021, Treasury released the most comprehensive revisions to the Compliance and Reporting Guidance for the SLFRF Program to date. The guidance provides additional detail and clarification for each recipient’s compliance and reporting responsibilities and should be read in concert with the Award Terms and Conditions, the authorizing statute, the Rule, and other regulatory and statutory requirements.

The Treasury is now accepting the Interim Report and the Recovery Plan Performance Report through Treasury’s Portal. Recipients should refer to Treasury’s Portal for Recipient Reporting, which includes step-by-step guidance for submitting the required SLFRF reports using Treasury’s Portal.

The Treasury also indicated that a forthcoming User Guide will provide information on submitting Project and Expenditure Reports. Additional resources located on its respective Recipient Compliance and Reporting Responsibilities page include the following:

- The Recovery Plan Template for States, territories, and metropolitan cities and counties with more than 250,000 residents;

- The Draft Non-entitlement Units of Government (NEU) Template; and

- The NEU Distribution Template User Guide.

It is important to note that the NEU Template is not the final version and should not be used for submission.[17] Recipients should use the template that will be posted in the Treasury Submission Portal once it opens to report information.[18]

Municipalities should conduct an in-depth review of the Reporting Guidance, as it provides additional detail regarding the information required to be included in each of these reports and is revised to reflect further reporting requirements as they become available.

Last Revised: November 19, 2021

[1] Previously, the Supplementary Information section preceding the Rule discusses Reporting requirements at a general level, noting, “Treasury will provide additional guidance and instructions on the reporting requirements…at a later date.” Treas. Reg. 31 CFR 35 at 112, available at: https://home.treasury.gov/system/files/136/FRF-Interim-Final-Rule.pdf.

[2] Department of Treasury, Coronavirus State and Local Fiscal Recovery Funds—Compliance and Reporting Guidance, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf.

[3] Id., at 12.

[4] Id., at 13 (see footnotes).

[5] Department of the Treasury, Treasury’s Portal for Recipient Reporting: State and Local Fiscal Recovery Funds, available at https://home.treasury.gov/system/files/136/SLFRF_Treasury-Portal-Recipient-Reporting-User-Guide.pdf.

[6] Department of Treasury, Coronavirus State and Local Fiscal Recovery Funds—Compliance and Reporting Guidance at 13, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf.

[7] Department of the Treasury, Coronavirus State and Local Fiscal Recovery Funds—Compliance and Reporting Guidance, at 13, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf.

[8] Department of the Treasury, Coronavirus State and Local Fiscal Recovery Funds—Compliance and Reporting Guidance, at 13-14, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf.

[9] Id., (see footnotes).

[10] Id.

[11] Department of the Treasury, Coronavirus State and Local Fiscal Recovery Funds—Compliance and Reporting Guidance, at 30-31, available at: https://home.treasury.gov/system/files/136/SLFRF-Compliance-and-Reporting-Guidance.pdf.

[12] Id., at 16-23.

[13] Id., at 15-16.

[14] Id., at 16.

[15] Id., at 23-30.

[16] Id., at 23.

[17] Department of the Treasury, Draft Non-entitlement Units of Government (NEU) Template, available at: https://home.treasury.gov/system/files/136/NEU-Distribution-Templates.xlsx.

[18] Id.