Program

COVID-19 Federal Assistance e311Topics

Housing & Rental Assistance, Infrastructure & Maintenance InvestmentsFunding Source

American Rescue Plan Act, CARES Act, FEMAMay a municipality use CRF funds for repairs to buildings used to address the public health impact of COVID-19, e.g., decompression shelters?

As outlined in the U.S. Department of the Treasury’s (“Treasury”) Coronavirus State and Local Fiscal Recovery Funds (“CSLFRF”) Final Rule, eligible uses of CSLFRF funds include supporting the COVID-19 public health response[1] through capital investments in public facilities to meet pandemic operational needs.[2] With respect to these eligible uses of CSLFRF funds, the Final Rule specifies that:

Capital expenditures, in certain cases, can be appropriate responses to the public health and economic impacts of the pandemic, in addition to programs and services. Like other eligible uses of [C]SLFRF funds in this category, capital expenditures should be a related and reasonably proportional response to a public health or negative economic impact of the pandemic. The final rule clarifies and expands how [C]SLFRF funds may be used for certain capital expenditures, including criteria and documentation requirements specified in this section, as applicable.[3]

The reopening of a building closed prior to the pandemic, together with capital investments (such as repairs) in the same, may be considered eligible expenses in certain circumstances. Eligibility may, for example, stem from a municipality’s use of the building as a decompression shelter in direct response to the COVID-19 pandemic.[4]

In recognition of the importance of capital expenditures in the COVID-19 public health response, the Final Rule clarifies that the following projects are examples of eligible capital expenditures:

- improvements or construction of COVID-19 testing sites and laboratories, and acquisition of related equipment;

- improvements or construction of COVID-19 vaccination sites;

- improvements or construction of medical facilities generally dedicated to COVID-19 treatment and mitigation (e.g., emergency rooms, intensive care units, telemedicine capabilities for COVID-19 related treatment);

- expenses of establishing temporary medical facilities and other measures to increase COVID-19 treatment capacity, including related construction costs;

- acquisition of equipment for COVID-19 prevention and treatment, including ventilators, ambulances, and other medical or emergency services equipment;

- improvements to or construction of emergency operations centers and acquisition of emergency response equipment (e.g., emergency response radio systems);

- installation and improvements of ventilation systems;

- costs of establishing public health data systems, including technology infrastructure;

- adaptations to congregate living facilities, including skilled nursing facilities, other long-term care facilities, incarceration settings, homeless shelters, residential foster care facilities, residential behavioral health treatment, and other group living facilities, as well as public facilities and schools (excluding construction of new facilities for the purpose of mitigating spread of COVID-19 in the facility); and

- mitigation measures in small businesses, nonprofits, and impacted industries (e.g., developing outdoor spaces).[5]

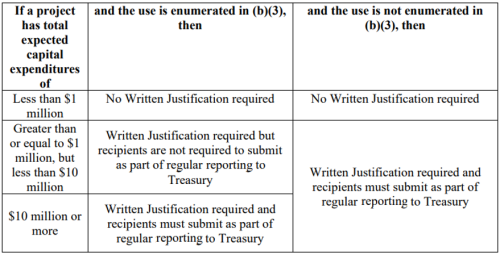

While capital improvement projects designed to alleviate the impacts of the COVID-19 pandemic in a proportional measure can be eligible for CSLFRF funds, Treasury requires the use of funds for certain projects to be supported by a written justification, as outlined in the table below.[6]

If the capital project does require a written justification, the Final Rule requires it to include the following elements:

- Describe the harm or need to be addressed;

- Explain why a capital expenditure is appropriate; and

- Compare the proposed capital expenditure to at least two alternative capital expenditures and demonstrate why the proposed capital expenditure is superior.[7]

Last Revised: February 16, 2022

[1] Treas. Reg. 31 CFR 35 at 54, available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[2] Id., at 60.

[3] Treas. Reg. 31 CFR Part 35, at 192 (emphasis added), available at: https://home.treasury.gov/system/files/136/SLFRF-Final-Rule.pdf.

[4] A decompression shelter is an overflow housing site established to reduce crowding in existing shelters. See Centers for Disease Control and Prevention, Interim Guidance for Homeless Service Providers to Plan and Respond to Coronavirus Disease 2019 (COVID-19), available at: https://www.cdc.gov/coronavirus/2019-ncov/community/homeless-shelters/plan-prepare-respond.html.

[5] Id., at 60-61 (emphasis added).

[6] Id., at 422.

[7] Id.